New hybrid work models

The COVID-19 pandemic forever shaped the office market, even 5 years later. The biggest change is the move to hybrid work models. McKinsey found that 58% of employees want to work in a hybrid environment. New ways of working, like splitting time between home and office, mean we need less full-time office occupancy.

But that doesn’t mean the end of the office as we know it. Companies still understand the value of face-to-face collaboration. However, the focus has shifted to flexible workplaces encouraging teamwork and creativity.

How tenant needs are evolving

Our recent market insights report has found that 64% of UK employees prefer flexible workspaces to traditional offices.So with hybrid work becoming the new norm, tenant needs are changing fast. Flexible spaces like communal spaces, collaborative hubs, and breakout rooms are on the rise.

Moreover, employees still go to the office for two reasons: team meetings and collaboration. Technology is important to tenants, too. Now, tech, equipment, privacy, noise control, and dedicated workstations are the main selling points.

Pre-register: Commercial Real Estate Market Insights Report

A look at 2024 commercial real estate provider opportunities

A shift in tenant expectations creates new opportunities for commercial real estate providers. It will help providers increase office space that responds to these evolving needs.

For example, unused office areas could become shared spaces. They could be co-working areas for small businesses and freelancers needing part-time office access or could be adapted to the evolving needs of companies.

Tenant experience and amenities

According to our research, high speed internet, printing and copying services, and having private offices are the top 3 amenities that offer a complete employee experience that tenants are looking for.

Today’s tenants also expect what we call digital-ready spaces. They want spaces with the integration of the latest technologies in place. These include touchless entry systems, energy-saving lighting, and more. These tech upgrades improve the tenant experience and cut costs.

According to research by Deloitte, 57% of tenants are more likely to take up smart, sustainable buildings. This is why investing in technology and green design is a smart long-term strategy.

What flexible leasing options can do for your occupancy rate

Flexibility is key in the coming years. For tenants, fixed, long-term leases are less attractive in uncertain economic climates. To attract tenants wary of long-term commitments, offer flexible leases. Short-term leases or lease restructuring options can help.

Higher occupancy rates will be in spaces easily adapted or reconfigured to respond to different tenant needs regarding flexibility. This will depend on their priorities. Some companies want hot desking. Others need private spaces for sensitive work.

According to CBRE’s report, flexible office spaces could comprise 30% of the office market by 2030—confirming the significance of this increasingly vital solution.

How data and insights can unlock occupancy growth

Space optimisation: How analytics play a role

Commercial real estate providers have powerful tools at their disposal: data. Providers can use analytics to track how office spaces are used and optimally layout the areas. Heat maps, occupancy sensors, and space reports provide real-time insights into tenant behaviour without invading into privacy.

Real estate providers can add value by finding underused areas. They should then make changes to use the space efficiently. For example, more flexible space configurations would better meet tenants’ needs.

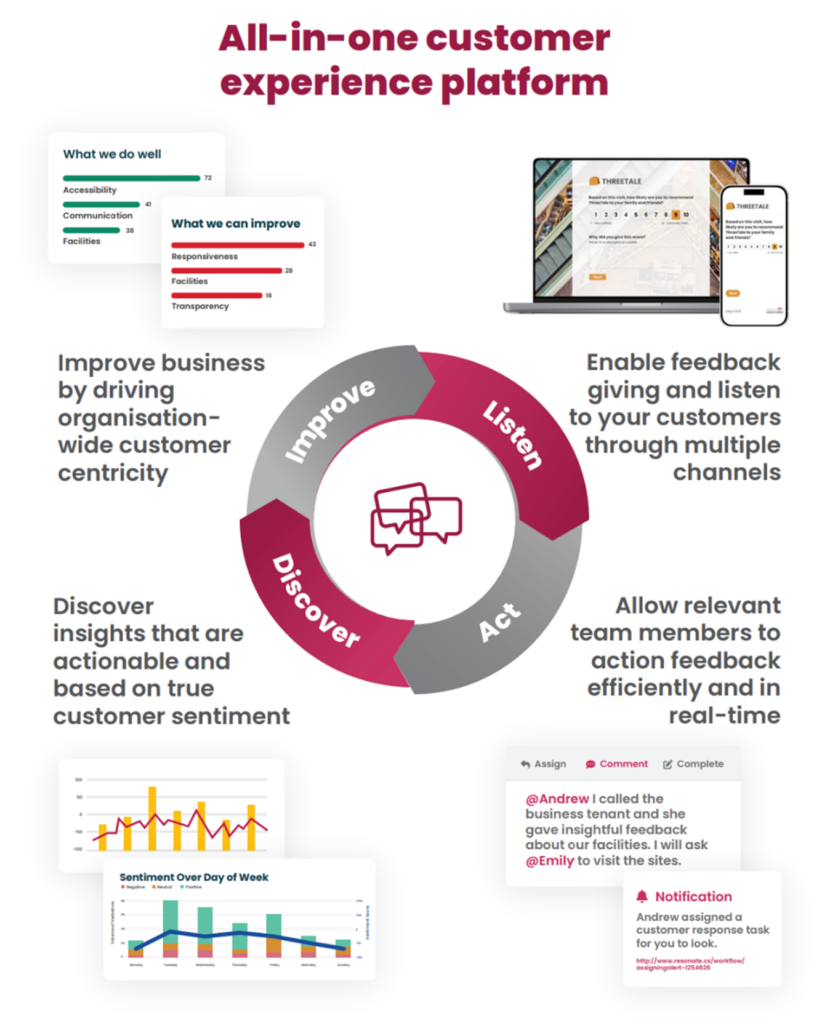

Preventing tenant churn and staying ahead of trends through customer experience insights

Keeping tenants doesn’t prevent tenant churn. Customer experience management (CXM) platforms can help real estate providers identify trends and the first indicators of customer dissatisfaction. Landlords can use tenant feedback, lease renewal patterns and occupancy trends to understand what brings tenant dissatisfaction, focus on improvements, and close the loop effectively.

For example, consistent feedback trends help providers proactively take steps, and match their offering with tenant expectations. By being data-driven, this approach not only decreases churn but also assists in stabilising occupancy and informs strategic investments for long-term growth.

Understanding trends and data for strategic investments

Commercial real estate providers can use trend analysis and data to help them make better investment plans. By discovering what tenants value most, providers can invest in upgrades that will make the most impact. As mentioned earlier, this can include modern amenities, sustainability,flexible leases or probably just better communication.

A big-picture view is key. Understanding these trends and data helps validate which improvements will resonate most.

Conclusion

In 2025, companies will be seeking out an office space that reflects their vision for the future of work. The commercial real estate providers can outpace the rest by providing flexible, tech-enabled, and sustainable spaces to meet these emerging needs.

By focusing on tenant experience, leveraging technology, understanding trends, and using data driven customer experience insights, providers can design office spaces that attract tenants and have a long term impact.

Drive higher occupancy, reduce churn, and unlock new revenue opportunities today.