What does a retail customer consider the best buyer experience? How does it affect your overall retail customer experience?

It seems like just about every retail customer type has tips and suggestions for how to improve their in-store customer experiences and make their shopping more efficient and enjoyable. In fact, 98% of respondents surveyed for Resonate’s latest commissioned market research report, “The Current State of Brick-and-Mortar Retail Customers,” suggested at least one improvement in each of four areas. Most retail customers highlighted improvements to product experience, followed by store experience, technology, and post-purchase service. These are important suggestions to keep customers in your store for longer and make confident purchases.

So, let’s dive right into an in-depth look at what your customers are telling you matters most to them in their in-store shopping experiences.

Types of in-store shoppers and what they expect

In our research, customers were divided into four groups by age. This is useful as age also correlates highly to income, employment levels, and marriage/family commitments. These retail customer types can be defined in general as:

- Eager Shoppers: aged 18-34; high income; single; no kids

- Time-Poor Shoppers: aged 35-54; high income; married with kids

- Hesitant Shoppers: aged 55+; middle income; married with kids

Promotions and deals for retail customer

So, what are these groups looking for in relation to product experience? All groups of shoppers told us that they want to find more promotions and deals when they go into stores. At roughly 60% of respondents in every age group, this was highlighted as a priority. Your retail customer wants to feel like they have received a special deal for coming into your store rather than just shopping online.

Range and choice of products

Around 50% of all shoppers said they’re looking for more range and choice of products, and this concern was highlighted by 60% of the older Hesitant Shoppers group. It’s crucial to know that this older group expects more of a product range to choose from, especially with products at different price points.

Accurate stock availability

Younger shoppers, especially in the Eager Shoppers group, do extensive research before coming into brick-and-mortar stores. Up to 60% of this group check stock availability before going into a store. While 40% of the other two groups expect more accurate stock availability, 60% of the young Eager Shoppers raised this as their second most important expectation. When Eager Shoppers read that the item they want is in stock and then head into your store only to be disappointed, they feel they’ve wasted a trip. Therefore, by keeping stock information online updated, you can give this cohort a much more seamless shopping experience.

Other minor points that all cohorts suggested to improve product experience include having more accurate price tags (30% of shoppers), more updates related to promotions and products (15%), and more eco-friendly products (15%). Though less-important suggestions, these are still areas in which product experience can be improved.

What customers want from retail stores

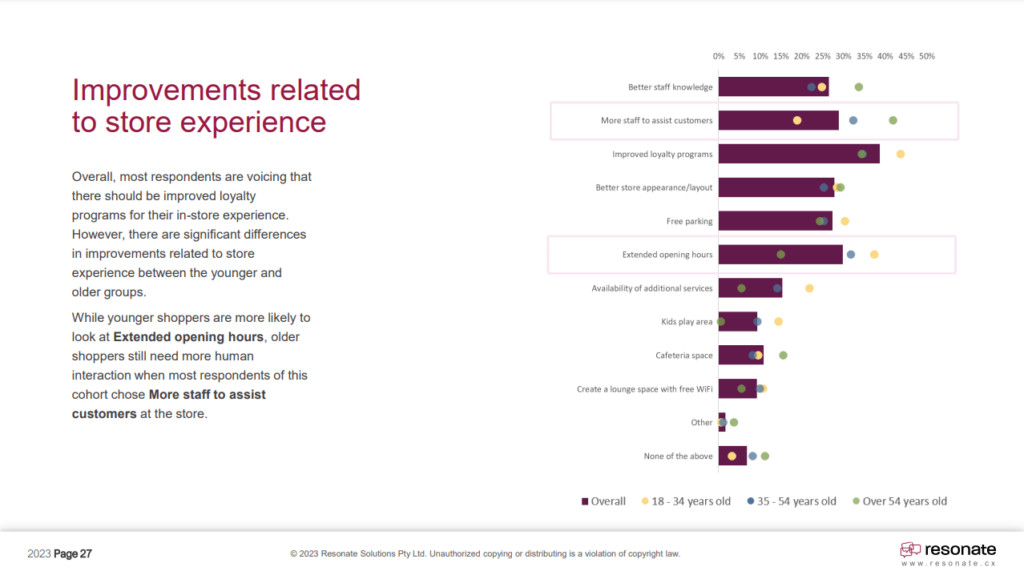

Respondents to our survey gave many suggestions for what they want out of a positive store experience. All shoppers together rank improved loyalty programs as the number one thing they want, as this would clearly encourage their brand loyalty. While this was the top pick for Eager Shoppers (almost 45%), the three cohorts differ a lot in what they want from their store experience.

The young Eager Shoppers are looking for ways to extend their shopping experience, which should be great news to retailers. They suggested extended opening hours (37%), free parking (30%), better store layout/appearance (27%), and better staff knowledge (25%) as the things they find most valuable.

The middle-aged Time-Poor Shoppers want more staff to assist customers (33%), extended opening hours (30%), better store appearance (25%), and free parking (25%).

In high contrast, the top concern for Hesitant Shoppers is more staff to assist customers (42%). This is followed by better staff knowledge (34%) and then free parking (25%).

The survey results show that younger shoppers are looking for more accessible stores where they can spend more time shopping comfortably in. Older shoppers are more concerned about getting the help that they need from their interactions with staff.

Minor suggestions given by all shoppers include the availability of additional services, kids’ play areas, cafeteria spaces, and lounge spaces with Wi-Fi. Once addressed all the major points in creating an ideal store experience, consider these additions as extras.

The importance of technology for retailers

How can technology enhance the in-store shopping experience?

Most of the suggestions put forward by survey respondents focus on billing and payment options. As you’d probably expect, younger cohorts consider the use of digital technology in retail stores to improve the in-store experience to be the most important. However, the way different cohorts focused on technological enhancements may surprise you.

Technology and retail customer

Hands down, the most important contribution to the positive in-store retail customer experience is having a digital price checker. For all shoppers, this tool increases the speed and accuracy of transactions and makes them more transparent.

Nearly 50% of Eager Shoppers indicated that a self-serve checkout was the most important piece of technology a store could offer. Next, they chose click-and-collect availability (43%), more payment options (30%), in-store navigation (26%), and self-serve kiosks (24%) as important technology contributing to their shopping enjoyment. These choices show a strong tendency for this younger group to navigate the shopping experience with the help of technology rather than store staff.

This was almost completely opposite to the older Hesitant Shopper cohort. While their next priorities are in-store navigation (33%) and more payment options (26%), self-serve options like checkouts, kiosks, and click-and-collect barely make it onto their radar. This cohort is looking for a way to navigate the store and make payments more easily but otherwise hasn’t really incorporated technology into their shopping behaviour.

The middle-aged Time-Poor Shoppers want technology to speed up their shopping. They want click-and-collect availability (33%), more payment options (32%), and self-serve checkout (32%) to help them save time.

Improved Post-Purchase Retail Customer Experience

After making their purchases, retail customers don’t see their shopping experiences as over. Instead, they want to still have options to interact with your store for different aspects of product support.

Over 50% of all shoppers indicated that they want easier refunds and exchanges. While this has always been an issue for shoppers, the era of online shopping with clear and quick refund and return policies has led shoppers to demand more from brick-and-mortar retailers.

51% of Eager Shoppers want flexible delivery services, likely because they have jobs and are single, so they often don’t have someone else at home who can take deliveries on their behalf. This is less of an issue for Time-Poor Shoppers (41%) and is hardly an issue for Hesitant Shoppers (25%) who have lower employment rates and, therefore, greater availability.

About a third of each cohort recommended that stores provide better helpdesk service, indicating that there is some need for post-purchase contact regarding changes and product use advice.

While 30% of Eager Shoppers and Time-Poor Shoppers desire free gift-wrapping in-store, only 15% of Hesitant Shoppers show interest in this service. And only about 15% of all shoppers were keen on more accessible instruction guides or demos being provided by stores. This could suggest that they go straight to manufacturers for this information or simply don’t find it enhances their shopping experience.

This is What Your Retail Customers Want

Your customers have spoken, and it’s time to listen to their suggestions and put them into action. Above all, shoppers want more promotions and deals in stores, improved loyalty programs, digital price checkers, and easier refunds and exchanges to improve their in-store retail experiences. Other improvements are based on the ages and demographics of your target retail customer base.

Your retail customer experience strategy matters. While there are many tools out there to measure interactions, a trusted customer experience platform is the go-to solution for most modern retailers. A good CX platform can enable your retail business to identify your strengths and weaknesses and analyse customer sentiments at breakneck speed.

So take these recommendations to heart, and you’ll be able to increase your retail customers’ experiences and, with them, their spending and loyalty to your store.

Read the full report here to learn more!